A Tax Upon The GOP

Obama may well be the best the shuck and jive master in the history of American Politics. America’s First Black President has successfully used the bully pulpit to further class warfare and to further fill the troughs for the eaters and takers on the strength of protecting the Middle Class while increasing their tax burden.

Obama may well be the best the shuck and jive master in the history of American Politics. America’s First Black President has successfully used the bully pulpit to further class warfare and to further fill the troughs for the eaters and takers on the strength of protecting the Middle Class while increasing their tax burden.

The boy, his female, and their brood are going to laughing all the way to Bill Ayers’ next dinner party / SPA fundraiser after pulling off this coup on the American people, as they should do. This was a manipulative masterstroke worthy of Black Folklore; Br’er Rabbit could not have done even one whit better.

Confused? Don’t be; it’s really simple once it’s explained. The deal, if one can call it that, that so conveniently ended the Democrats’ Fiscal Cliff scare included a lot of extensions on entitlements and subsidies to the eaters and takers but didn’t include an extension of the payroll tax cuts.

Since the majority of the Republicans are the ones who pay payroll taxes and the majority of Democrats are the ones who don’t, Obama and the Democrats have maintained the subsidized lifestyles of their constituency while raising taxes upon the GOP’s constituency by allowing the payroll tax rate to return to it’s old level.

Isn’t That Racist?

As the majority of people within America who pay payroll taxes are not just Republicans but also happen to White and the Majority of those who don’t are both Democrat and Black, this tax increase is, de facto, race-based and disproportionately impacts Whites. Isn’t that racist by longstanding Liberal logic?

Oh wait! Nevermind! Nothing that negatively impact Whites while not negatively impacting Blacks can ever be racist. I forgot that the Liberal criteria for racism is inherently racial in nature.

~*~

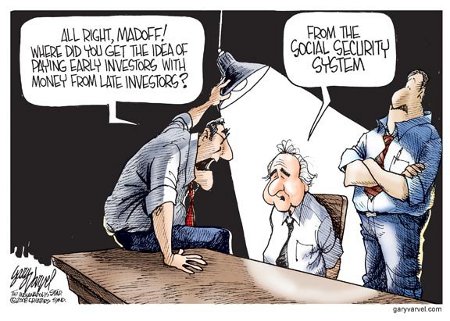

OK, humor and sarcasm aside, it’s good that the payroll tax holiday was allowed to sunset. It never should have been granted in the first place given the insolvency of SSI. That doesn’t however change the fact the Obama and the Dems gulled the people into thinking that they were protecting them from tax increases while quietly increasing the taxes upon the Middle Class.

Tags: America | Blacks | Democrats | Grifters | Humor | Lies | Obama | Politics | Racism | Republicans | Sarcasm | Social Security | Taxes | Whites

Obama had claimed that America was at a “

Obama had claimed that America was at a “ America’s Campaigner-in-Chief, Obama, thinks that gutting Social Security is a good thing but wants to push the GOP into being the ones that do it. Or, at least, that’s what

America’s Campaigner-in-Chief, Obama, thinks that gutting Social Security is a good thing but wants to push the GOP into being the ones that do it. Or, at least, that’s what