Voting With Their Feet

Bad policies matter, something that Democrats, the primary source of policies which are untenably bad for those who actively contribute to and grow the economy, don’t seem to be able to learn this. Or, since those who can be described as the Makers aren’t normally their constituencies, they don’t care. That’s why a lot of these Makers are voting with their feet.

Now, nationally it’s still a small thing, but one that has increased dramatically. Only about 2.5% of the current US population has emigrated. But that’s a little over double what it was 20 years ago. The numbers of wealth generators, i.e., actual taxpayers, who have internally migrated is far more stunning, and that’s what is actually important.

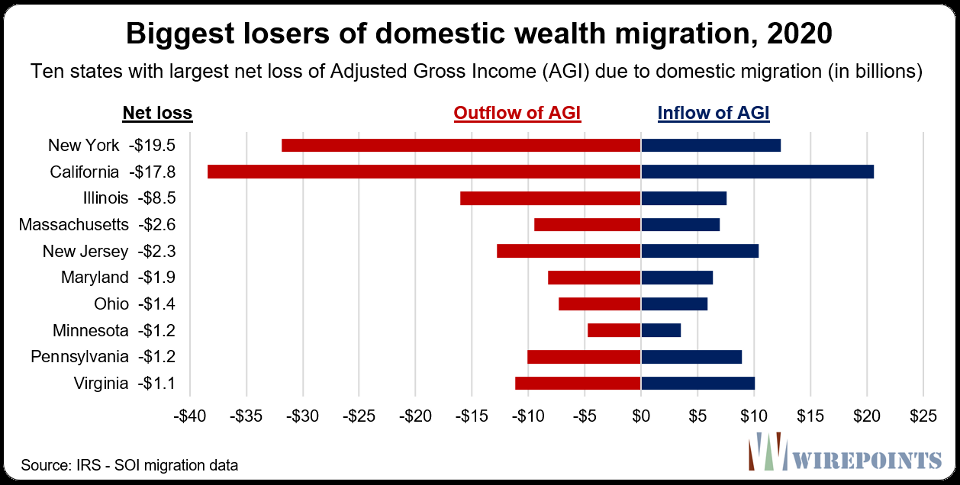

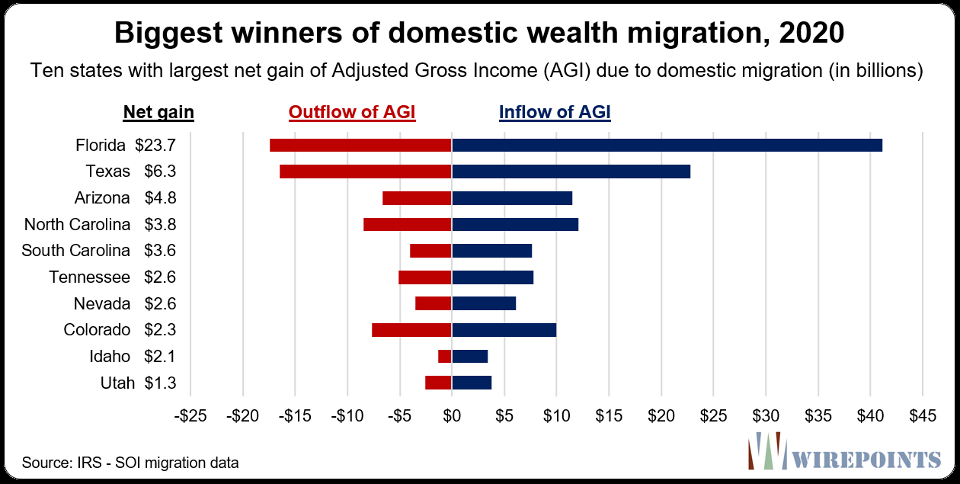

Which States Are Winning And Loosing

(Click Either Image Below To Enlarge)

As you can see, people with wealth are leaving Blue States in very expensive droves. Well, expensive to the Leftist governments of those Democrat safezones. Loosing over $55 billion in residents’ Annual Gross Income is no small or easily coped with thing for state governments. And the numbers shown are just personal monies. It doesn’t include all the businesses moving out of Democrat-controlled zone.

And, while this is going to have very large impact on politics, the economic impact and the follow-on effects thereof are going to be more important as we move into the not too distant future. It is not unwarranted to posit that many of the Left-wing areas will go the way of Detroit, which is still on track for effective abandonment, not being able to sustain its infrastructure without the tax monies of those who fled mismanagement and a government antagonistic towards those who generate actual wealth.

Yeah, millions of Americans are voting with their feet. And, their voting against Democrats’ bad ideas and punitive policies.

Tags: America | Blue States | Democrats | Economic Collapse | Economics | Economy | Emigration | Exodus | Immigration | Liberals | Politics | Progressives | Red States | Society | Taxation | Taxes | Taxpayers | White Flight